Fact-check: has Gai Construction been paying tax in relation to the Banjul Rehabilitation Project?

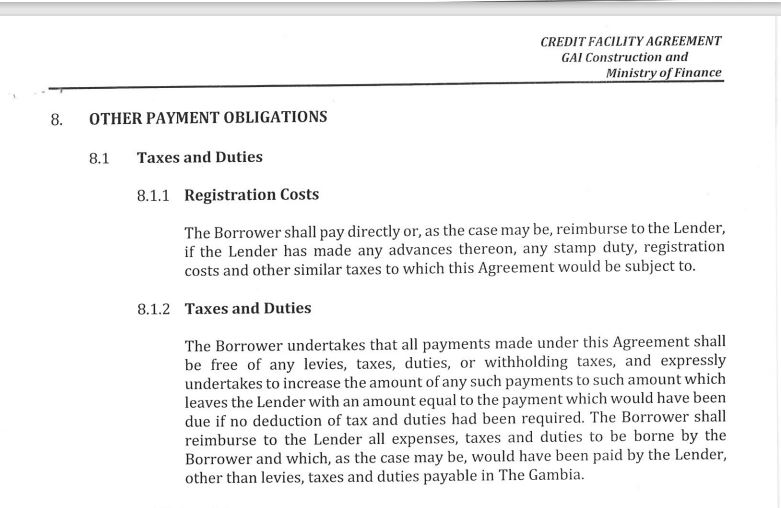

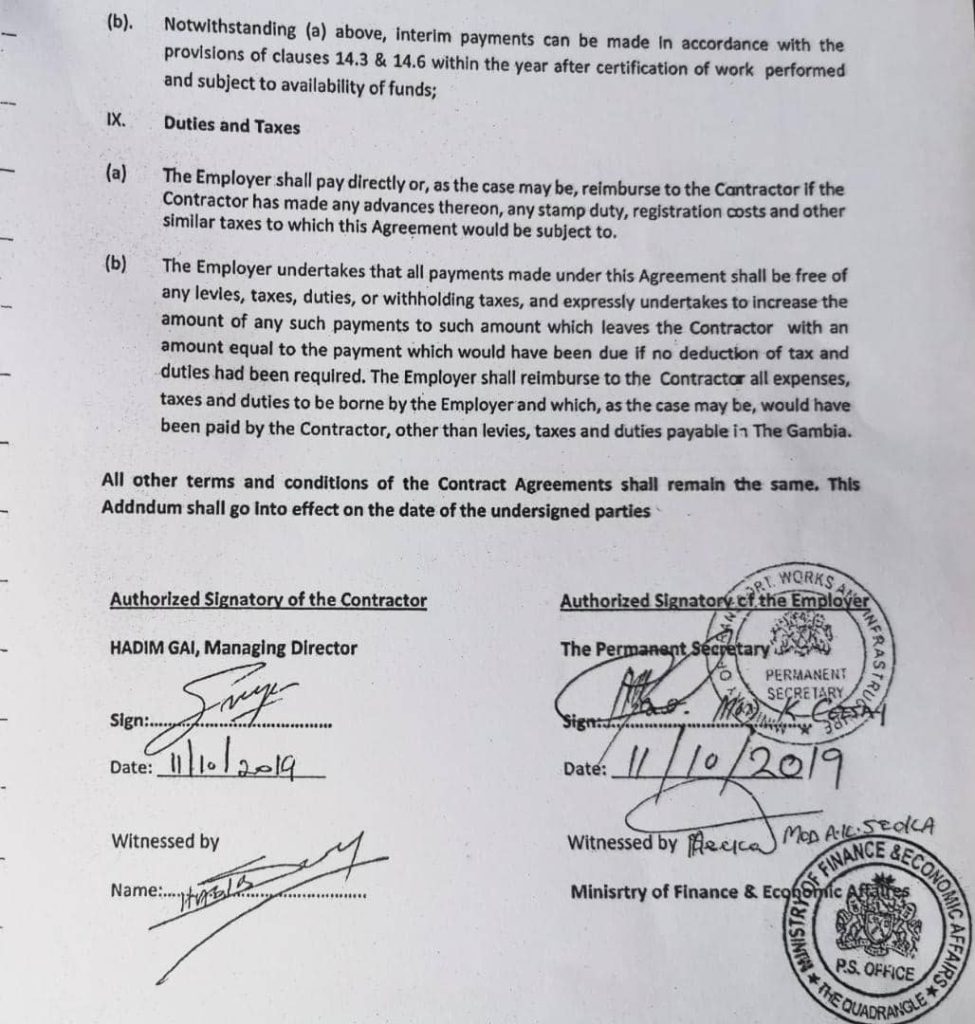

While the addendum signed on October 11, 2019, nullified the credit facility, changes the currency of payment from USD to dalasis though the costings all remain in USD. That first addendum done in 2019 nullified the credit facility which carried the first tax exemption granted to the contractor. The authorities then include a similar tax exemption and duty waiver in the addendum.

Claim: Mr Gai regularly honoured his tax obligations and submits his company’s audited accounts on time.

Source: Yankuba Darboe, Director General of the Gambia Revenue Authority

Verdict: Misleading

The Gambian authorities have recently come under heavy criticism after parts of the capital, Banjul, submerged in water due to heavy rains. The critics said the contractor, Gai Construction, that has been awarded over a $35 million project to rehabilitate the roads, sewages and drainages in Banjul had done a bad job.

On September 1, the government held a press conference meant to defend the work of the contractor who is said to have done a satisfactory job so far. The press conference came on the hills of a release of the audit by the National Audit Office on the project which exposed flaws in the awarding of the contract and a tax exemption that did not follow due process, among others.

Claim

During the press conference, the director general of the Gambia Revenue Authority, who also graced the occasion—Yankuba Darboe—said the contractor paid tax.

“Mr Gai regularly honours his tax obligations and submits his company’s audited accounts on time. As far as we are concerned the man is always filling his taxes and based on what he is filing is where we tax him and there are facts to prove that,” said Darboe.

“Anybody, being a project or not, if you have an economic activity in this country and you are getting money you will pay tax, and Gai Construction is also paying tax.”

Fact-check

The Banjul Roads, Drainage and Sewage Project was signed in May 2019. After that, two addendums were made to the initial contract. One that was signed on 24 February 2021 extended the contract by 12 months and add several roads, walkways, and drains to the existing contract.

While the addendum signed on October 11, 2019, nullified the credit facility, changes the currency of payment from USD to dalasis though the costings all remain in USD. That first addendum done in 2019 nullified the credit facility which carried the first tax exemption granted to the contractor. The authorities then include a similar tax exemption and duty waiver in the addendum.

This is why the auditors from the National Audit Office have explained in their audit that the contractor is not paying withholding tax in relation to the project.

According to the auditors, the contractor owed a withholding tax amounting to D114,185,501. The position of the auditors was that the tax exemptions and duty waivers did not follow due process.

Duties waivers and tax exemptions should either be granted through a special investment certificate issued by Gambia Investment and Export Promotion Agency (GIEPA), or by the President with the approval of the National Assembly. The tax exemption granted to Gai Construction did not follow these processes.

Verdict: the response of the GRA director is misleading as it failed to address the tax exemption associated with the contract: withholding tax. While the tax exemption may not have followed the law or due process, it is still in the contract and the contractor is not paying withholding tax.