Gambia Records Surge In Remittances Despite Dreary Forecast

Experts say surge in remittances could help struggling families as key revenue-generating sectors in the economy take a nosedive...

Gambia has recorded an unexpected surge in remittances coming into the country, defying global forecast of a sharp decline. On April 22, the World Bank predicted 20 percent decline in remittances, the sharpest in recent history due to Covid 19.

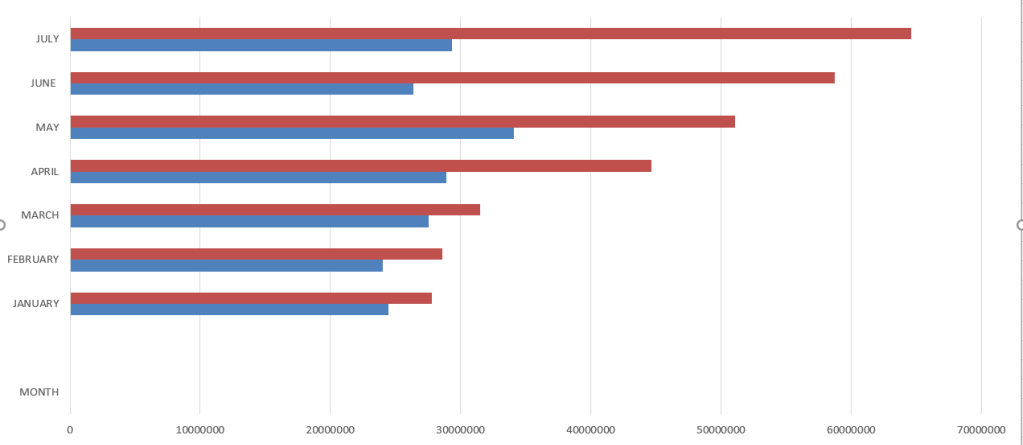

According to the data collected by the Central Bank and shared with Malagen, Gambia received US$306,995,434 in remittances by July 2020. This is 93% of the entire remittances of 2019 which was US$329,793,949.

Remittances account for about 22% of Gambia’s gross domestic product (GDP). At least 36 per cent of nearly two hundred and eight thousand households in the country receive remittances, according to a 2017 government survey.

The inflow comes either from a member of the household or an individual outside of the household, paying for basic necessities such as food and housing while creating thousands of jobs in the construction industry every year.

“Without remittances the Gambia’s poverty rate, which remains at 48 percent, could be over 70 percent,” said a US-based Gambian researcher and economist Cherno Omar Kebbeh. Kebbeh did an extensive research on the estimates of the Gambia emigrant population.

Kebbeh added: “Remittances are an integral part of the Gambian economy – serving as an important source of foreign currency for the government and a critical source of support for many households.”

Gambia has seen a steady surge in remittances in recent years. Last year – 2019 – witnessed massive increase, registering US$329.7 million, compared to US$228 and US$245 received in 2017 and 2018, respectively.

Gov’t battles revenue shortfalls

For economist Nyang Njie, the current state of the Gambian economy can be compared to the country’s historic recession in 1985 when it adopted an economic recovery programme. Since March, all of Gambia’s key economic indicators have taken a nosedive. Due to Covid 19-induced crisis in key revenue generating sector like tourism, the Gambia Revenue Authority (GRA) projected a sharp decline in their revenue, said Ousman Bah, institution’s head of corporate affairs.

GRA expects to collect D2 billion less of their projected D12 billion for 2020. As of July, the institution has collected its D1 billion target but there is projection of possible crisis in the country’s tourism sector come October when the season begins which will affect tax collection significantly.

“Tourism drives agriculture, especially horticulture,” said economist Nyang Njie. “It drives fisheries… So, Gambia unfortunately suffers two blows within this short period: the bankruptcy of Thomas Cook and the pandemic.

“A lot of people: waitresses, securities, chefs are all out of work because one of the drivers of the economy, tourism, is at its lowest ebb since the 1994 coup when there was an embargo.”

From tourism alone, the “economy is projected to lose USD108.5 million (D5.6 billion),” according to reports from the Gambia Tourism Board (GTB). This figure is expected to increase to D6.7 billion if Covid 19 is not contained by October, 2020.

Tourism accounts for up 20 per cent of Gambia’s gross domestic product, the third largest contributor, trailing agriculture and services sector. The industry provides employment to more than 110,000 people – 41,000 of whom are directly employed.

Earlier in April, Finance Minister Mambury Njie revealed that Covid-19 will cost Gambia a revenue loss of D1 billion, widening the country’s budget deficit to D2.5 billion.

The economy, before the spread of Covid 19, was projected to grow by 6.3 percent in 2020. By early April, this growth projection was revised to 0.5 percent.

“The low anticipated growth is as a result of the terrible effects of the Covid 19 pandemic on tourism, fishing, construction, wholesale and retail,” Mambury Njie told lawmakers on June 24.

Supports received

Gambia is one of Africa’s highly indebted countries, owing creditors over D68.8 billion from within and outside of the country. However, due to the coronavirus pandemic, several international creditors granted the country a debt referral.

In April, the International Monetary Fund granted the country a debt relief, saving the small nation up to US$2.9 million (D150.2 million) in additional resources. In total, Gambia benefited from four debt referrals, amounting to D287.2 million, according to the Finance Ministry.

These were D82.8 million from Ecowas Bank for Investment and Development, D19.3 million from Saudi Fund for Development, D172.6 million from Kuwaiti Fund for Arab Economic Development and D12.3 million from Peoples Republic of China.

But aside from the debt referrals, several partners including the World Bank have given the country monetary support. In June, the World Bank approved US$35 million grant to support the country’s efforts to improve effectiveness in fiscal management for better public service delivery.

The International Monetary Fund approved a credit facility of little over D2. 441 billion dalasi ($47.1 million) for the country. The finance ministry withdrew 25 percent, little over D610 million, from the Central Bank as a domestic loan to be paid once IMF loan arrives.

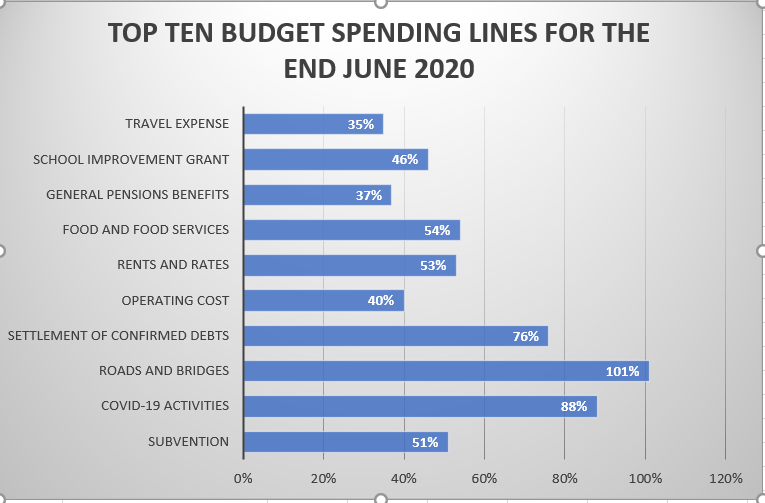

But according to Nyang, these funds are not being spent wisely. “If you look at our resources relative to where we are with the pandemic, I think it is a cause for concern… Most of the monies that came through budget support…, were not wisely spent as it relates to Covid 19…,” argued Nyang Njie.

Nyang added: “In terms of making Gambia have a soft-landing out of this pandemic, the government doesn’t have a strategic plan in terms of having social measures to help… I can safely tell you Gambians are in need of help.”

“About 70% of Gambians live on less than US$2 a day. So, having the economy coming to a halt means that most of these people will not have means of sustaining their livelihoods.”

Meanwhile, Gambia Covid 19 infection cases continue to increase reaching 3029 on Monday. Between March and June, authorities spent D1.18 billion of D1,345 billion approved for Covid 19 activities. They would later increase this D1.3 billion allocation by another D250 million through a supplementary appropriation in July.

According to the directorate of budget at the Finance Ministry, D273 million was spent on hotels, vehicles, food, allowances, among others, as of end July.